Toyota appears to be on the verge of a manufacturing breakthrough that could propel the transition to electric vehicles. But will the technology ever be commercially viable?

In 1992, SONY sparked a revolution in portable electronics. With decades of experimental research into lithium-ion batteries, the Japanese company has been able to launch products that have changed the lives of billions of consumers, such as mobile phones and handheld cameras.

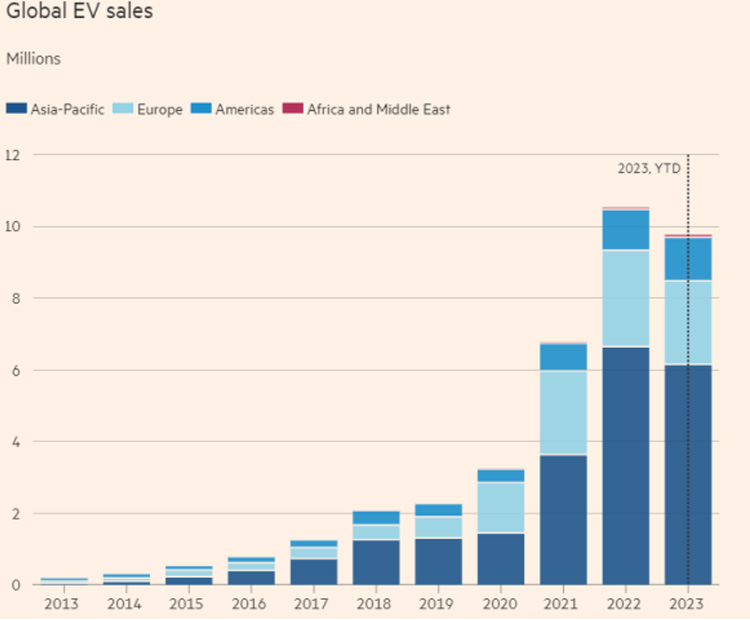

Today, batteries underpin the enormous task of transforming global energy and transportation systems to reduce dependence on fossil fuels. Although the cost of producing lithium-ion batteries has fallen dramatically, which has led to a huge increase in electric vehicle sales in recent years, the fundamentals of the technology have changed little since its commercialization.

After three decades of incremental optimization, however, this belief may soon be upended. Toyota, the world's largest automaker, recently said it was close to a manufacturing breakthrough for a potentially game-changing technology - solid-state batteries. The hype has been building since the Japanese automaker made a series of announcements about the next-generation technology in June. Since then, Toyota's market value has risen by $26 billion.

If successful, Toyota could start selling electric cars that are safer, charge faster and can travel up to 1,200 kilometers on a single charge by 2027, nearly double the company's current average.

"There's a global race going on to develop solid-state battery technology," said Peter Bruce, co-founder and chief scientist at the Faraday Society in the UK. "If Toyota or other companies can successfully develop solid-state batteries that are cost-competitive and have a long enough lifespan, they are expected to achieve improved energy density and charge in 10 minutes." If they meet these standards, it will be disruptive to the industry."

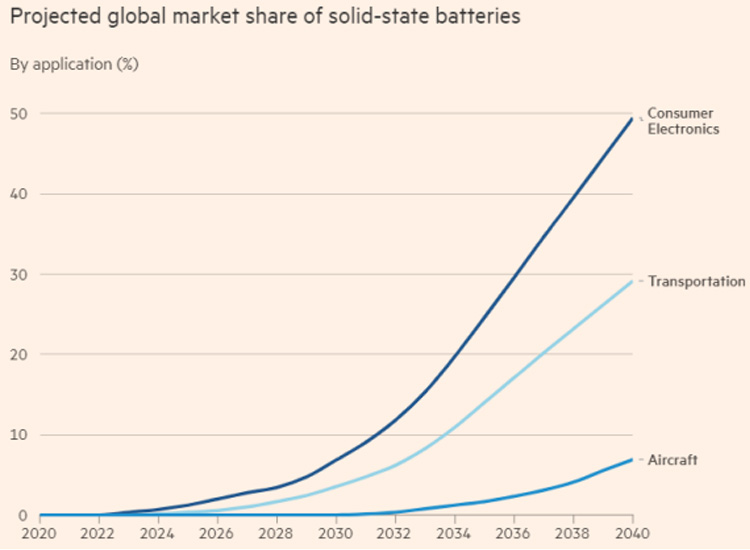

If the technology is successfully applied, the implications could be huge. It will subvert the current electric vehicle and battery market dominated by Tesla, China's BYD and Ningde era, and will have a profound impact on the electric vehicle industry. It would also have geopolitical significance, given Western concerns about China's current dominance of batteries and their raw materials. In addition, solid-state battery technology is also expected to expand to new transportation applications such as aviation.

Some observers believe this technological shift could be as significant as the transition from landline and landline phones to mobile phones in the past.

However, solid-state battery technology is not without its skeptics. Critics question whether basic science questions have been addressed; There are also questions about whether high-speed mass production is feasible and whether the market scale will ever exist.

"The enthusiasm around solid-state battery technology means that existing solutions are not good enough. But this is clearly not the case. Electric vehicle sales are growing 20 to 30 percent a year, and almost everyone who has tried it says they are not going back, "said Alex Brooks, an analyst at TD Securities in Canada. "Right now, it's just a much-hyped research project."

The dashboard of a Toyota electric car. Solid-state batteries could help Japanese automakers catch up with the rest of the world when it comes to electric vehicle strategies. © Kiyoshi Ota/Bloomberg

Toyota's latest claimed breakthrough once again raises the question of how quickly solid-state batteries can play a significant role in decarbonizing the world's transportation systems. Venkat Srinivasan, director of the U.S. government-funded Argonne Collaborative Center for Energy Storage Sciences, calls it the "ultimate goal" for the battery industry, but in the long term, he poses a question: "Do these interesting lab innovations still have a lot of technical hurdles to overcome before they can be manufactured at scale, or can they be put into production soon?" I'm still thinking about that."

Solid foundation

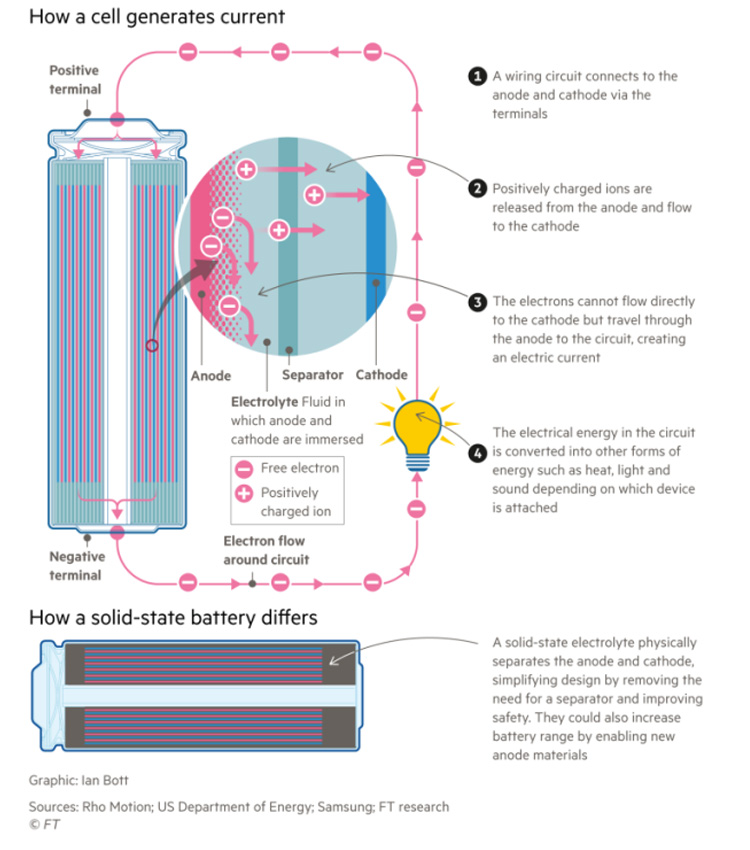

All batteries work the same way: electrically charged atoms, also known as ions, flow from the negative to the positive, the battery's two electrodes, a process that occurs in a chemical called an electrolyte, which creates an electric current.

Solid-state batteries differ from current lithium-ion batteries in that the electrolyte is a solid rather than a liquid. Different materials, including polymers, oxides and sulfides, are being tested as potential electrolytes. Cars that use solid-state batteries will be safer because liquid electrolytes may be more likely to cause fires.

But simply replacing the electrolytes won't necessarily lead to a major improvement in battery performance. What is really exciting is a possible technological development, namely the lithium metal negative electrode. Replacing the graphite currently used in the negative electrode with lithium metal would help double the battery's range, in part because it is lighter.

Solid-state batteries have long faced fundamental technical challenges. One of the problems is the difficulty in maintaining battery performance and avoiding failures, because repeated charging and discharging can cause lithium to form a dendritic structure, which can cause the battery to crack. Another challenge is to achieve stable contact between solid materials.

The first "breakthrough" Toyota claimed in June had to do with solving a durability technology problem, although details on exactly which material led to the breakthrough were limited. Last week, they announced a partnership with petrochemical group Idemitsu Kosan to jointly develop and produce sulphide electrolytes, which they say will be key to commercialisation within five years.

CATL factory transport truck. Researchers at the manufacturer have been working to crack solid-state batteries for the past decade. © Xinhua/Shutterstock

Confident in the range and charging time of electric vehicles, Idemitsu's CEO Shunichi Kito said at a press conference with Toyota: "We are convinced that sulfide-based solid electrolytes are the most promising solution to the problem of battery electric vehicles."

Scientists increasingly agree that the fundamental technical challenges no longer seem insurmountable. This makes the next challenge to achieve mass production. The assembly process is one of the biggest hurdles, as the positive-negative battery layers need to be stacked quickly and with high precision without damaging the material.

Toyota engineers also claim to have made progress on this front. The group is increasingly confident that it can stack batteries at the same speed as current lithium-ion batteries.

However, other technical hurdles still need to be overcome to achieve full-scale mass production. "We still need to make breakthroughs in ensuring the quantity and quality of battery materials," one of the engineers said during a factory tour last month.

Global impact

The introduction of solid-state batteries could profoundly affect the future of the global automotive industry.

Currently, China is poised to dominate the next phase of the industry thanks to its leadership in battery technology and manufacturing: According to the International Energy Agency, China produced more than 75 percent of the world's batteries last year.

CATL is the world's largest battery manufacturer with a 37% market share. The Ningde-based company is the most profitable battery maker, in part because of cost advantages from its scale and investment in research and development.

Solid-state batteries may be the only way to overtake Beijing in the battery race. Toyota is far from the only company investing in the technology. Nissan and Honda have their own projects. South Korea's three largest battery producers, LG Energy Solutions, Samsung SDI and SK Corporation, have all announced that they plan to develop such batteries in the late 2020s. U.S. startups QuantumScape and Solid Power, which have partnered with Volkswagen and BMW respectively, have similar target dates for commercialization of their technologies.

Akitoshi Hayashi, a professor at Osaka City University, said it would be "extremely challenging" to mass-produce solid-state batteries of the same quality as current lithium-ion batteries, but if achieved, the technology would be "unrivalled in global leadership."

"Solid-state batteries will be key to the revival of Japanese automakers as they have fallen behind in their electric vehicle strategy and Japan has lost global market share in lithium-ion batteries," he added.

China also controls the processing of raw materials for batteries. Solid-state batteries could reduce certain weaknesses, such as the current reliance on graphite, which the Chinese government imposed export restrictions on last week. But solid-state batteries will do little to alleviate the projected lithium shortage, as they consume even more than current batteries.

Industry leaders in China and South Korea are not optimistic about the prospects for solid-state batteries. According to a person close to CATL, researchers at the Chinese group have been working on cracking solid-state batteries for the past decade. They have yet to find a cost-effective system for mass production - and there is skepticism within CATL that Toyota has achieved that goal.

Korean industry leaders feel the same way. "Developing a product and commercialising it are two different things," says one executive. Toyota has been talking about mass production of solid-state batteries for more than 10 years, but they've been dragging their feet."

Manufacturing barriers

Even if the technical and scale challenges can be overcome, it is a big unknown whether solid-state batteries can reduce production costs in time to accelerate the global rollout of electric vehicles.

Economies of scale will help keep costs down. However, with the advancement of other technologies such as silicon negative electrodes, the performance and cost of lithium-ion batteries are also improving. The extreme sensitivity of solid-state batteries to moisture and oxygen could keep manufacturing costs high, while their complexity could require expensive redesigns for electric vehicles.

If costs don't come down enough, solid-state batteries could end up being limited to luxury cars or trucks. Kim Dong-myung, head of the advanced automotive battery division at South Korea's LGES, said producing solid-state batteries was "too expensive" and had "a very limited range of applications." Lee Kyung Sub, head of the battery materials business at South Korean conglomerate Posco, estimates that even if all goes according to plan, solid-state batteries will only account for about 10 percent of the overall EV market by 2035.

Toyota CEO Koji Sato has been cautious about whether solid-state batteries can play a "game-changing" role in the global electric car race. Koji Sato said that solid-state batteries will initially be launched on a small scale for high-end models, while more affordable cars will continue to use lithium-ion batteries.

"Solid-state battery technology will play an extremely important role in the overall strength of our various battery products, but the battery itself will not determine the value of our vehicles," Koji Sato said last week.

Many industry executives believe that solid-state battery technologies will gradually be integrated into current batteries. Catl seems to be planning to adopt this strategy, launching a new "concentrated" or "semi-solid" battery in April that has twice the energy density of current models.

Shirley Meng, a battery professor at the University of Chicago, said: "Fully solid-state batteries should have their mission. The task of the new battery is not to replace the old battery, but to unlock features we couldn't achieve before. With new range and charging times, Japanese car companies are reimagining the future of transportation."

While many technical hurdles remain, some observers believe the potential impact of the technology could be profound. Significantly improved batteries have the potential to reshape many aspects of global mobility, from driverless taxis to regional aviation and new types of drones.

Contact: Jason Wang

Phone: 13580725992

E-mail: sales@aooser.com

Whatsapp:13580725992

Add: No.429 Guangming Road, Shenzhen City, Guangdong Province

We chat