Lithium-ion batteries are in wide demand and are mainly used in 3C consumer electronics, transportation power and energy storage. According to the "2021 China Lithium Battery Industry Development Index White Paper" issued by CIDI Research Institute of the Ministry of Industry and Information Technology, the global lithium-ion battery market scale reached 5445gwh in 2021, among which, China's lithium-ion battery market scale was about 324GWh, accounting for 59.4% of the global market. In addition, the sales volume of Chinese lithium enterprises (including export and foreign branches) amounted to 382GWh, and the share of Chinese enterprises in the global market reached 70%.

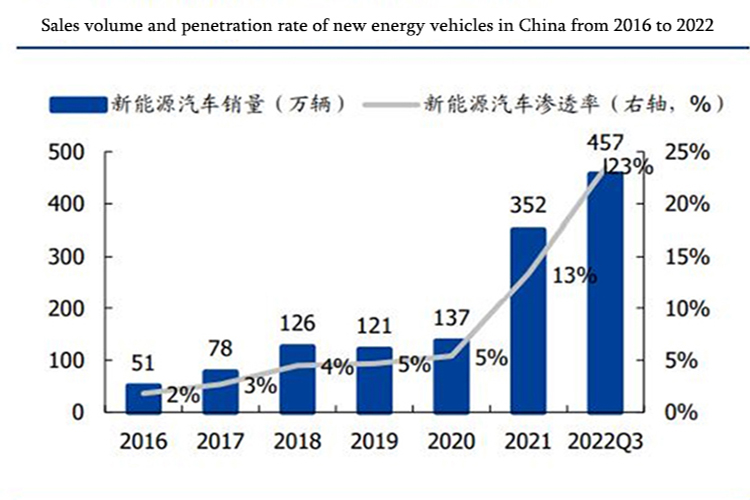

Specific application form: Power battery is mainly used in the field of power, including new energy vehicles, electric forklift and other engineering equipment, electric ships and other fields. Demands status: The new energy automobile industry of our country has entered the stage of rapid development under the guidance of the "dual carbon" policy, and leads the global sales of new energy automobiles to continue to rise. According to the "New Energy Vehicle Industry Development Plan (2021-2035)", by 2025, the sales volume of new energy vehicles will reach about 20% of the total sales volume of new vehicles (Q3 data in 2022 shows that the penetration rate of new energy sales has reached 23%). The explosive growth of new energy vehicles will continue to drive the growth of power battery installations.

Applicable battery type: At present, power battery types are mainly divided into lithium ion battery, nickel metal hydride battery, fuel cell and so on. According to the White Paper of China's Lithium Industry Development Index, the power field has a high demand for energy density, charging ratio, life, consistency and other performance. When the energy density of the system reaches 160kw/kg, the demand is differentiated and the life demand is at least more than 2000 times. Lithium-ion batteries have become the mainstream of new energy power batteries at the present stage because of their comprehensive advantages such as high working voltage, large specific energy, small volume, light weight, long cycle life and relatively mature technology.

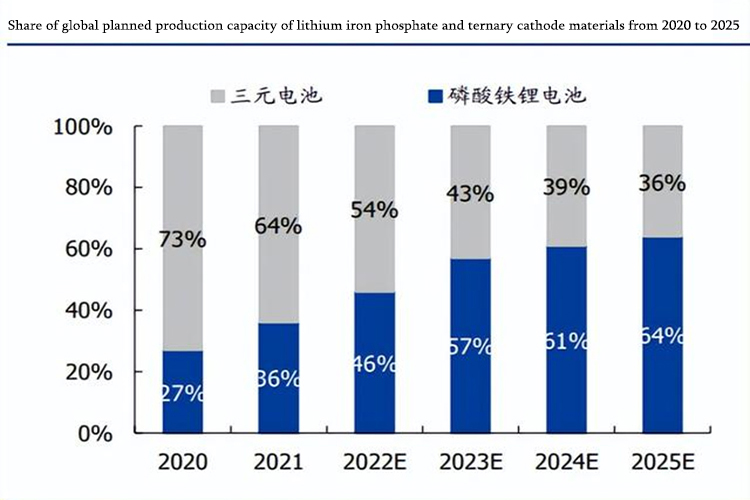

Mainstream lithium ion power batteries can be further divided into lithium iron phosphate and ternary lithium batteries. Terene lithium battery fully combines the characteristics of nickel, cobalt, manganese (aluminum) and has obvious advantages in energy density, but its raw material cost is high, so it is mainly suitable for passenger cars. Lithium iron phosphate batteries have higher safety and lower cost than ternary lithium batteries, but the energy density of lithium iron phosphate batteries is limited, and there is an energy density bottleneck. Driven by many factors, such as the effect of subsidy policy and technological progress, the installed quantity of ternary power battery and lithium iron phosphate battery showed an alternating rising trend.

As the core components of new energy vehicles, lithium iron phosphate batteries and ternary batteries have been in a long-term competition. From 2016 to 2019, due to domestic new energy vehicle subsidies to high mileage, high energy density and other factors, the proportion of three-way battery increased rapidly, and exceeded the proportion of lithium iron phosphate battery installed. However, simply relying on subsidies to guide the market to increase the driving range also creates safety risks for battery safety. In order to get the highest subsidies, new energy vehicle enterprises blindly increase the number of batteries and improve energy density, ignoring battery safety issues. Spontaneous combustion incidents of new energy vehicles occur from time to time, which also leads to the public's skepticism towards new energy vehicles.

In 2019, subsidies were gradually withdrawn, "state subsidies" were almost halved, and "land subsidies" were completely canceled. In April 2020, four ministries and commissions jointly issued the Notice on Improving the Fiscal Subsidy Policy for the Promotion and Application of New energy Vehicles. It makes clear that in principle, the subsidy standards for 2020-2022 will be reduced by 10%, 20% and 30% respectively on the basis of the previous year, and that new energy vehicles licensed after December 31, 2022, will no longer be given state subsidies. Automobile enterprises have increasingly high requirements for electric vehicles to reduce costs and improve safety, stability and quality. Lithium iron phosphate battery manufacturers have intensified research and development efforts, launched a number of new products, and made breakthroughs in performance. But relatively speaking, the technological iteration of ternary battery is short of new products, and the lithium iron phosphate battery has a stage advantage. The mainstream technology route of future power battery is still variable. The main cost-effective lithium iron phosphate can not stand long-term price rises. If the price rise trend of lithium carbonate continues for a long time, the cost advantage of lithium iron phosphate will gradually disappear, and the launch of 4680 ternary battery and the process of high nickel cobalt-free ternary battery is expected to bring reverse opportunities.

Applications in the consumer sector started early and grew steadily. Specific application form: Consumer lithium ion battery started earlier in the lithium ion battery industry, and occupies an important position. Consumer lithium batteries are widely used in 3C digital products such as mobile phones and computers. In addition, they also cover smart meters, intelligent security, intelligent transportation, Internet of Things, intelligent wearable, power tools and other fields. Currently, computer and mobile phone batteries account for half of the market, but the share of battery shipments for emerging consumer electronics is on the rise.

Demand: With the iteration of traditional products and the emergence of new products, the consumer electronics market maintains a steady growth. According to GGII, global consumer lithium ion battery shipments will reach 95GWh in 2023; Shipments of Chinese consumer lithium-ion batteries will increase from 31.4GWh in 2018 to 51.5GWh in 2023, representing a growth rate of 64 percent. Applicable battery type: According to the White Paper of China Lithium Electric Industry Development Index, fast charging and long battery life have become one of the innovation trends of consumer batteries in recent years. The demand for volume energy density and charge and discharge ratio of batteries has increased, but the consumer field is less sensitive to cost, consistency and other performance, and the life can reach 800 times.

3C is still mainly lithium cobaltate, and the market share of high-nickel ternary will gradually increase. In addition, lithium-mangan-based batteries rich in lithium are expected to take the lead in carrying out small-scale trials in 3C field during the 14th Five-Year Plan period. In the field of electric bicycles, lithium batteries based on lithium manganate will replace lead acid and become the mainstream technology. Lithium iron phosphate will also accelerate its application in the field of electric bicycles and power tools after the price returns to normal.

Energy storage has broad application prospects. Specific application form: energy storage battery uses the conversion between electric energy and chemical energy to realize the storage and output of electric energy, which is an important energy system supporting the energy Internet. Demand status: As intermittent new energy such as wind power, hydro power and solar power are connected to the grid at higher speed under the background of low-carbon energy structure transformation, the demand for energy storage system with power dispatching function will increase substantially. Mainstream energy storage systems include physical energy storage represented by pumped storage and electrochemical energy storage represented by battery energy storage. At present, pumped storage is widely used due to its low cost, long life and mature technology, but its development is gradually slowed down due to factors such as geographical environment constraints, high investment and long construction cycle. The electrochemical energy storage system is less affected by geographical conditions and has a short construction cycle. It can be flexibly used in all aspects of the power system and other various scenarios, gradually becoming the mainstream of newly installed energy storage. In the future, with the further appearance of scale effect of lithium battery industry, there is still a large space for cost reduction and broad development prospect.

Types of applicable batteries: Energy storage batteries are mainly divided into lead-acid batteries, sodium-sulfur batteries, flow batteries, lithium-ion batteries, etc. Among them, lithium-ion battery energy storage system occupies an absolutely dominant position in the global power market due to its significant advantages such as high specific power and energy, low self-discharge, low pollution and decreasing cost. According to the White Paper of China's Lithium Power Industry Development Index, the energy storage field is highly sensitive to cost, and has high requirements on the consistency and life of battery products. However, it is less sensitive to energy density, and the life demand is at least 5,000 times. In the short term, lithium iron phosphate batteries are mainly used, and some sodium ion batteries may be used as supplements in the future.

In recent years, the global lithium ion battery product structure is accelerating adjustment. With the rapid growth of the new energy vehicle market, the proportion of power pool has increased significantly. In 2021, the proportion of global power battery products reached 66%, an increase of 12 percentage points year-on-year; In China, the growth rate is more obvious, with power battery products accounting for 68% in 2021, an increase of 15 percentage points year-on-year. In addition, with the rapid penetration of lithium-ion batteries in energy storage power stations, 5G base stations and other fields, the market share of lithium-ion batteries for energy storage is increasing. In 2021, the global share of energy storage batteries will reach 12%, and that of energy storage batteries in China will reach 10%. In addition, consumer electronic products maintain steady growth, among which portable global portable computers grow rapidly but mobile phones have a steady decline. In 2021, the combined market share of global and Chinese consumer lithium-ion batteries fell to 22%.

Contact: Jason Wang

Phone: 13580725992

E-mail: sales@aooser.com

Whatsapp:13580725992

Add: No.429 Guangming Road, Shenzhen City, Guangdong Province

We chat